The Journey (pt. 3)

Part 1 was the dream.

Part 2 was the reality.

Part 3 is the actualization.

Dream

There’s a stark difference in my tone compared to part 1. Having been humbled by the market and also having had experienced what it takes to be a consistently profitable trader has leveled my perspective in a lot of ways. I spoke a lot about how I had self-belief, how my life would be transformed and why I wanted to take on this journey. I wanted to pave my own way, I wanted to do something with immense potential and I wanted to share that with my family, friends and future wife.

I didn’t know how I was going to do it, but where there is a will, there is a way… right?

Floundering around for about 8 months, I decide that enough is enough and that I spare no expenses in my own business. No more bullshit chatrooms, no more discount brokers and no more excuses. I was going to succeed by giving myself the best chance and that breakthrough really helped me realize the catalyst for my early success.

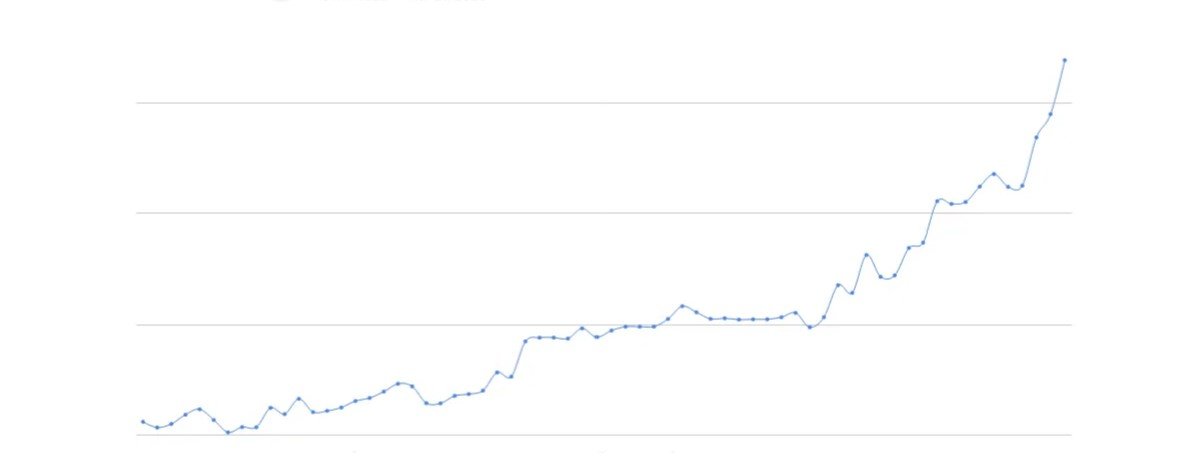

Having learned how to execute a strategy, manage risk and ultimately view the markets as a risk/reward game, I was able to compound my account to great heights.

I finally made it, I finally had my ‘a-ha moment’. Turns out I was dead wrong and making money doesn’t mean anything, there is an insidious aspect to the market and it isn’t your enemies abroad, it is literally YOU.

Reality

In part 2 reality hit me in the face like a ton of bricks. I lost my father, I lost my account, my relationship was on the brink and I had nothing but ONE Hail Mary attempt at redemption. Struggling with having done everything right, only to lose it all was devastating beyond belief. For the first time in my life, my impression of the future was torn completely asunder.

Through pain comes promise, nothing could’ve set me up better for today than reality humbling me to my knees. I shifted my complete attention towards meticulous scrutiny of my previous mistakes and pledged to completely surrender to the fact that I was going to grind out my wins as if I had started from scratch. I completely reset my size, completely opened my mind to the possibility that I could do and be more, and went to work every day harder than the year before.

Swings from high to low, achievement to setback, it was an endless fight for survival. I had dipped towards PDT several times with 0 ability to recover the account if I failed.

It took perseverance to weather the storm, but every time I got out of a rut I was reborn. For every optimization, efficiency and countered error, I was met with an infinite, and ongoing, supply of experience to rely on.

Breakthrough after breakthrough, centered around a strict focus on risk management, and finally I was able to live up to the shadow of my former year.

I took pause, looked back and reflected on what I had done up until this point and realized that back then, I didn’t really know anything at all. My ongoing process made my old system look like a house with no roof. I had a solid foundation, but if it ever rained in sunny California then I was going to be drenched. So then, I spent the entire year building my roof… brick by brick.

Painstakingly it takes one day at a time, we can only expose ourselves to so much of the markets. Equities are trading 5 days a week and I needed 8 days a week to catch up to where I wanted to be by this point in my life.

After one year of fighting for my life, I finally hit my target goal in January of 2020.

Actualization

Immediately I hit the ground running into the new year and set a personal best PNL which was 2x my last years highest month. In March, I had bested that personal best almost by 100% and have made more than in the entire year of 2019 alone.

Here’s the truth… everyday I am actually anxious because I have no clue what is going to happen. I don’t understand the economy, I don’t understand the pandemic and the implications on our markets… the only thing I understand is my system. I literally show up every morning with impostor syndrome even after all this time and do exactly what I do every day. The truth is that, while the pandemic has certainly heated our markets up, I am exhausted… There are so many opportunities to research, review and acknowledge that I can’t trade every single thing. I have focused my attention on the small niche I’ve always been trading since the beginning, that’s it. I’ve learned that I cannot trade everything so far, that is when I lose. Those experiences guided me to be the trader I am today and to rely on consistency first and foremost.

I have designed my trading to be as systematic as possible, whereby I have done the prep work beforehand to understand it’s edge and let that edge express itself through my execution. In the end, it doesn’t matter how I feel or what I think I should be doing because my system will always be right, that is what got me where I am today. Undoubtedly I have put in a massive amount of work into my trading and, for that, I am able to be consistently profitable without needing to feel confident, comfortable OR pretend that I can predict the outcome of any given scenario. This is my bedrock, this is my foundation and I hope that you readers can achieve something similar by hearing my testimony. I come across like I am having a very difficult plight but, in reality, I am so happy when I am trading. I am personally fulfilled by putting forth effort and reaping the rewards of my integral grind, I’ve never felt so happy and financially confident in myself before. Actualization, to me, is the combination of the dream and the reality. I know what it feels like to be leveled to absolute rock bottom and the significance of building back up with pure grit. This truly feels like the turning point.

What I had learned by fighting my way out systematically in 2019 set me up for a host of positive habits and systems.

Here is how I am taking my consistency to a new level in 2020:

RISK, RISK, RISK (Management). This is #1, above all risk management is the number 1 key-factor in my redemption. Have a FUCKING max loss and obey it. This alone will save you, how many people do you know blew up a majority of their profits by getting too heavy and proud to accept a loss? I can name several traders that I’ve seen up until this point and guess what, none of them had a max loss. Let me set the record clear, I am, in no way, mentally or emotionally stronger than I was the day that I lost it all. The difference is that I identified and implemented the ONE thing I could find out of all of the supposed ‘advice’ that you see out there. The book Atomic Habits shaped every aspect of my life and trading to the degree that I was able to reach clarity about accepting that I am a human and I am emotional, therefore I will act irrationally in certain moments. The counter to this is by creating systems! A system is a hard-set and predetermined response to a given outcome. If X happens, then Y. Not only this, but I am totally out of control. It is important to find ways to create avoidance or be held accountable by another source such as a broker rejecting your order because you really shouldn’t be trading after a string of losses. I can rely on this intervention, I am not about to breathe deep, meditate, change my posture, sleep perfectly, journal it out, ignore FOMO, ignore my rage or having 100% discipline. The reality of the situation is that it only takes 1 time, literally 1 crippling mistake to throw your entire journey out the window. I really do not care how disciplined or motivated you are, you need help and accepting yourself as a flawed being is the key. It literally infuriates me to see anyone I know or a follower come and tell me that they lost it all by not having a max loss, I’ve been tweeting and blogging about it for exactly 1 year now.

Risk to Reward (Risk). This is nothing new to my feed and I’m sure you know that it comprises the majority of my feeds history. The thing is, the relationship between these two factors is so nuanced and deep that I feel that I am still beginning to scratch the surface. For starters, risk/reward is the basis for taking your system and backing it by mathematics and probability. Without an understanding of your average winners, loser and winrate you will be so unclear about your drawdowns and expected outcome. If one compares trading an edge to the profitability factor of a casino, then one would understand that it is just a numbers game involving time. I always have my heart set on the outcome of 100, 1000, 10000 trades ahead. I intend to be trading for as long as I can and that takes the pressure off in a big way. OK, but I really meant to talk about this aspect of risk/reward. In trading, we often think REWARD from the outset and onwards into our journey. Making MORE money per trade is a good thing right? Counter-intuitively there is an unsettling drawback to this and it is a reduction towards your winrate. Re-watching Phil Goedeker’s, better known as Ozarktrades’, Chat with Traders episode years later, I found his insight to be particularly pivotal in my journey. To paraphrase, he said that when he was pushing himself more and more, he realized that another way to make more money per year was to simply reduce the size of his losers on average, to eliminate big losses as much as humanly possible. This inverts the formula and takes it in the other direction towards the aspect of risk. By focusing on the ability to reduce the size of losers, I was able to turn my average losing trade to around .7R from 1R. This, bolstered by my newfound focus of getting high reward setups in the form of A+ sizing, lead me to massively outweigh my losers and provide additional mental capital, risk aversion and confidence to take those profits and compound them. Nowadays you’ll find that my winrate was significantly decreased but it is because I track all of my executions by hand, papercut after papercut. Tradervue will say that my stats are 54% winrate overall, whereby my stats produce 30% win overall. Astoundingly I am green 70% of the trading days this month, with a winrate far less than ideal for most.

Risk to Reward (Reward). My number one goal in trading is consistency. I have been playing it safe since the day I lost everything. I do not regret it for one moment, in fact it gives me so much peace that I have no qualms about taking -7R in a day even. I can take punch after punch and get back up because I’m never trading above my means and I’m never selling myself short either, no pun intended LOL. Essentially I am treating all setups within my criteria equally and accept the inherent risk because I understand the quality of my equity curve will reflect massive positive expectancy given my stats and track record. I know for a fact that I will be profitable in the long-run, the only issue is my own emotions and man-made errors. I like to think of myself like a monkey pushing the buttons of a system that literally knows far better than I do. Back to reward… I have always been maximizing reward and I have several blogs out outlining some of the steps I have taken and a lot of the psychological and emotional aspects that come with the territory. I have had a lot of growth as a result, finding my happy medium, however I’ve never really pushed myself on setups I considered ideal. The main reason was having my focus completely on reaching my goal in the most consistent manner possible without random variables. I wanted to achieve consistency on a level that was undoubtedly earned and true to my process. Now, having done this, I am ready to focus on amplifying my success by taking additional size on A+ opportunities. So far, I have been able to identify several opportunities and actually have a 100% winrate, which WON’T last btw, on those picks. This has lead me to have my single largest win ever on a trade and it feels damn good. I am able to translate that into covering a ton of losses in the future and it gives me confidence to keep the ball rolling, mental capital. A big thanks to AlldayFaders for sharing this amazing insight with me:

The key takeaway is that his disposition towards opportunity is that he REFUSES to accept the usual results when the potential is there. This mindset has really changed the way I view my setups, all trades being equal until the iron is hot. Systematically approaching it has lead me to define the parameters of where and how to add as part of my system and also how to size proportionately. Currently I am running a 2x size on A+ setups as I am still quite comfortable taking a larger loss in the event that I am wrong and not completely destroy the consistency that I’ve built. So long as I have this aspect in control and stay within my means, which I’ve proven that I can do, then I will be able to take my trading results to the next level.

4. A focus on Execution! I’ve always said that a lot of my friends could destroy me if they traded my strategy because their execution has always been top-notch compared to mine. In fact, I understood my weakness so much so that I had reduced my position sizes on average and broke apart my system to calculate in chasing, visually curb FOMO and take as much discretion out of it as possible. That has always been a decent solution, given my propensity to trust my system completely. However, there’s always been this irking feeling that I could be, and do, better. I wanted to be better and so, having had hit many milestones, I decided to focus entirely on execution. I was really laser-focused on discovering ways to amplify my strength in systems building and sideline my weakness in poor execution. This lead me to a mathematics-based model that was part of my core system in late 2018, believe it or not. One of the best aspects of Google Sheets is that you can really go back into your history and bring back the nuggets of your past. I was able to identify, with new eyes, that this system could be incorporated into my existing one with a few tweaks. And so, I spent about 7 days without rest backtesting this system and making the UX of my design the most efficient it could be. This includes color-coating, positioning and order of operations with inputs to be as seamless of a transition as I could make it. In the end, I was consistently able to achieve larger RR just based on entries alone and reduce my losses by cutting several erroneous potential points of failure from my old ways. I do not want to give much detail away, I hope you understand. It brings me more pride to see my executions on point than to even win a trade, for if I did the best I could then I have nothing to regret. I should’ve really approached this issue sooner. Sometimes it just takes hyper-focus on one aspect of your trading to get things to the level they need to be instead of splitting your attention several ways. By getting one thing out of the way you are able to now move on and evolve… I think the mindset stems from our inability to be cognizant of our greater purpose and timeline at all times. We feel that we should be able to do this, that and the other simultaneously, but the truth is that it’s just one finely laid brick at a time to build the house you want to live in forever. So to sum it up, my execution is now tied to risk, tied to reward and tied to my overall success but I am able to take advantage of the mental clarity associated with it. I implore you to really deep dive into your strengths and weaknesses and devote serious effort towards getting that to where you want it to be.

5. Pay Yourself. As far as I’m concerned, whatever’s in your trading account is still an unrealized gain until it cashes into your bank account. That is capital up for risk, there’s no doubt about it in my mind. For a retail trader, the emotions of being true professional and treating this like a business is in our ability to actually support ourselves through our trading. Having had lost literally every gain I’ve ever had in 2018 at the end, I had learned to respect those imaginary points we rack up each day. It’s surreal that we can press buttons and that money can do things in the real world. I have only JUST recently allowed myself to buy any frivolous things besides food and living expenses. Paying oneself creates a sense of security and that leads to better trading simply put. I am always pulling profits out over my predetermined account size and that allows me to have such a keen sense of objectivity with my trading. I am able to identify that I am not trading well during drawdowns and I’ll be damned if I put a cent back into this brokerage account that charges me an arm and a leg to begin with. This, even though I am significantly up overall, keeps me humbled as if I were a beginning trader. I treat my account with so much care and caution that I get little spurts of motivation to work extra hard at night to make myself a better trader. As time goes by, it becomes harder and harder to reach new efficiencies and plateaus when it comes to skills. Moments like this are precious to me because I can immediately detect that I am pushing myself to succeed even when I am not in dire straits, so to speak. They allow me to keep my drawdowns really tight, believe I have absolutely 0 ‘cushion’ (I HATE the idea of cushion), and to learn some serious lessons when available. On another note, one great tactic I use is that I will schedule an email to my broker the next morning before the open to wire out gains, so that I immediately understand it’s banked. This allows me to take losses with grace and understand that I will be able to support myself and my loved ones no matter what. Stacks of money really become just that when we start losing appreciation for what we have. When I’m able to look at the world and define my purchases or vacations in terms of R, it really makes things quite interesting. I literally throw a wad of cash down the drain before I even make a trade by locating shares and I wouldn’t even buy myself new clothes, such as the socks with holes in them that my fiance absolutely hated to see OR to buy gifts for my loved ones during holidays which will show them that I care and love them? I can now define expensive purchases by my R and realize it’s potentially one trade, half a trade, not even an R and so forth… my mind is thinking about value very humorously now. I begin to appreciate the world in a different sense, knowing that people literally kill themselves working for someone else’s ambition and get horrifically underpaid, while I can live a life based on my own efforts… it’s beautiful. I can enjoy events, I can treat my friends/family and do all the things I wouldn’t do before because I know that this is a realized gain, it’s mine. Overall paying oneself is such a big big big factor in my personal trading and something I don’t hear elaborated on enough. Put your freedom first, remember why you are even trading to begin with and don’t let it get to your head either. I feel just as terrible with every loss as the first day I started and I will never accept anything less than perfection, money is just the score and a reflection that I’m trading well. Winning is not everything, I would rather lose trading well than win trading like a jackass.

Okay, that’s all the steam I have for this post. Thank you very much for reading the blog and I implore you to read the other ones if you haven’t already. Feel free to let me know how you liked it on my twitter and ask me any questions if I can be of value to you. This is part 3 of my ongoing trading journey.

With gratitude,